Online Accounting Software Small Business Accounting

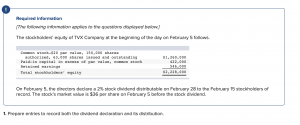

Without basic bookkeeping practices, it’s easy for financial transactions and spending activities to get out of control, which can lead to confusion, disorganization, and loss of profit. Xero’s online accounting software is designed to make life easier for small businesses – anywhere, any time. Set up bank feeds from your accounts so transactions are imported securely into the Xero accounting software each business day. Every financial transaction should have a line item in the general ledger, which tracks everything in one place. The general ledger notates the account number to which the debit or credit is applied.

Does your virtual bookkeeper have experience in your industry?

- Staying on top of your bookkeeping is important so that you don’t have unexpected realizations about account balances and expenses.

- There are several key rules of bookkeeping to keep in mind, but one of the most important is regarding debits and credits.

- In addition, the course will have students evaluate risk response using data analytics and audit sampling for substantive tests.

- And…it’s the #1 most profitable business according to Entrepreneur Magazine.

Forbes Advisor analyzed 13 online bookkeeping services and considered 15 metrics such as price, features, customer service, ease of use, integrations and service level. We also looked at real customer experiences to determine if their expectations were met based on what each company promised. After assigning a weighted score https://www.kelleysbookkeeping.com/ to each category, we formulated rankings for each company. A degree in accounting qualifies you to work in a number of positions related to accounting and finance. With a bachelor’s degree, you may be most qualified for entry-level positions as a bookkeeper, accounts payable specialist, or assistant payroll administrator.

How do I start virtual bookkeeping?

One of the biggest benefits of virtual bookkeeping is helping companies save a ton of time and money versus hiring an in-house bookkeeper. Bookkeepers are experts at managing the day-to-day finances of a business. They give small business owners vital information to make better financial investments down the road. Some clients will do work at their site, like entering bills, writing checks, sending invoices, and more. In this case, you’ll be responsible for ensuring they make proper entries, reconcile accounts and bank statements, get financial documents, and more.

Understand your funding options

While they are both subtracted from your business’s total sales figures, they should be recorded separately. You can calculate COGS by adding the cost of your inventory to the purchases made during a specific time period. Subtract the cost of inventory left at the end of your timeframe to calculate your COGS. Sales tax is added to the retail price of every online sale and is settled at checkout.

Students will also be introduced to tax research of complex taxation issues. Since bookkeeping is a more straightforward process than accounting, it is something that many people can (and do) opt to take care of themselves. As your business grows and you begin making higher profits, hiring staff and handling more transactions, definitions in accounting however, it may make sense to outsource the details of bookkeeping to someone else. While they seem similar at first glance, bookkeeping and accounting are two very different mediums. Bookkeeping serves as more of a preliminary function through the straightforward recording and organizing of financial information.

How often are you looking at your total current income and total current expenses? Leveraging bookkeeping services allows you to look at your income and expenses in real-time frequently. Having access to robust reports and financial statements allows you to make better decisions for your business leading to an increased ROI from investing in online bookkeeping services. Bookkeeping services can also help small business owners save more through tax preparation and tax filing.

Christine is a non-practicing attorney, freelance writer, and author. She has written legal and marketing content and communications for a wide range of law firms for more than 15 years. She has also written extensively on parenting and current events for the website Scary Mommy. https://www.accountingcoaching.online/what-is-a-depreciable-asset/ From University of Wisconsin–Madison, and she lives in the Chicago area with her family. Below are some of the most common statements a bookkeeper uses to monitor activities. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets. If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum. Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases.

QuickBooks Online has some of the best reporting and bookkeeping features money can buy. Xero, Sage Business Accounting, and Zoho Books have stellar reports at a lower starting price than QuickBooks. And if you want straightforward finance tracking without in-depth analytics, Wave Accounting can help you with the basics.

At the end of the accounting period, take the time to make adjustments to your entries. For example, you may have estimated certain invoices that are later solidified with an actual number. Start by determining how you’ll log your inventory and whether you’ll use the FIFO, LIFO, or average cost valuation method. Then use an inventory management system to accurately track your inventory, and make sure you audit it on a regular basis. Even if you have little bookkeeping experience, you now have firsthand knowledge of and access to all your financials, which puts you in a powerful place to make informed decisions about your business’s future.

That includes choosing when to send invoices, how quickly you expect them to be paid, and which payment methods you'll accept. You can look at freelance sites, such as Upwork, to see what others are charging for bookkeeping services, but you can also learn a lot by asking around. Talk to businesses in your area to see what they are currently paying for bookkeeping services. Talk to people in your network who are also bookkeepers and ask what they are charging. In doing so, you can get a good idea as to the range bookkeepers charge for services.

Leave a comment