Average car finance rates of interest by the credit rating

Every - please view companion site getting latest details. Price may vary according to credit score, credit score and you may mortgage identity.

Although situations subscribe to the attention rates you will be given getting auto loans, your credit rating is one of influential. Understanding average car finance rates from the credit rating will provide you a concept of everything you you'll qualify for that assist your see whether you will get an effective rates on your own car mortgage.

In this post, we at the House Media studies team falter auto loan interest levels because of the credit rating for new and you will used car finance. I together with consider how automobile financing works and where you could find the best car loan rates to suit your borrowing reputation.

Financial institutions class anyone toward groups - both entitled borrowing rings - centered on credit-rating designs such as FICO and VantageScore. Whenever you are additional factors impact the car finance rates you might be considering, the credit ring their score falls towards is one of important.

The following desk shows the brand new ranges regarding scores that define such classes, and mediocre auto loan cost for brand new and you may car commands for every single classification. This data comes from Experian's current State of your own Motor vehicle Loans Business report .

How automobile financing works

A car loan is a kind of secure financing that uses the car which is being funded since the security. After you financing an automobile, the financial institution will get the fresh lienholder and that is who owns brand new automobile identity if you do not afford the mortgage from.

Basically, this means that even though you have the right having and make use of the vehicle, it is the lender that truly has it. If you cannot make your financing costs, the lending company can repossess the automobile.

When you shop to possess automobile financing, you will likely see them stated of the apr (APR). So it shape is sold with your interest rate together with charge and other will cost you that are included with the mortgage.

First completing loan applications, consider using a car loan calculator to acquire an enthusiastic notion of exactly how rates apply to everything you will spend. Many mortgage hand calculators will let you enter into basic pointers eg your need amount borrowed, rates and you can term to see exactly how much your own month-to-month car repayments would be and how much you'd pay during the attention over the longevity of that loan.

Exactly what items connect with car loan cost?

Vehicle loan providers set rates of interest situated in region toward opportunities away from payment. The new riskier the borrowed funds is for the lending company, the better the speed chances are so you're able to charges. Several affairs indicate chance so you can lenders and can affect the interest rate you earn toward that loan.

- Credit rating : Your credit rating is the component that deal probably the most pounds. The low your own get is actually, the better your interest might.

- Credit history : Your credit rating belongs to your credit score, nonetheless it actually it all. Loan providers examine a detailed credit history complete with details about how much cash of your own readily available borrowing from the bank you might be playing with and you can whether you have skipped monthly installments.

- Mortgage label : Car loans tend to have terms and conditions between 12 so you can 84 months. Longer terms and conditions typically change to reduce monthly obligations, but they together with often include large rates.

- Markets prices : The common field speed is a huge factor in the pricing you get. Loan providers to change their cost predicated on what they shell out so you're able to borrow money, therefore you will observe large pricing should your mediocre interest rate goes up.

- Loan-to-really worth (LTV) proportion : The newest LTV ratio expresses just how much of an excellent vehicle's worthy of is lent. For www.cashadvancecompass.com/loans/borrow-money-online-instantly/ example, if you'd like to obtain $20,one hundred thousand to possess a vehicle which is really worth $40,000, that is a keen LTV proportion away from fifty%. The low the LTV ratio are, the lower their interest could be.

- Downpayment : The down payment, whether within the dollars or perhaps in the form of a trade-in the, impacts the brand new LTV ratio. You can find zero-money-down auto loans, but you'll typically advance interest rates by simply making a bigger deposit.

- Debt-to-money (DTI) ratio : Their DTI proportion 's the count you pay into the debt burden monthly compared to the monthly income. Whenever you are the debt circumstances into the credit rating, lenders may also check your DTI ratio to see how far you might realistically afford to shell out. The lower your ratio off financial obligation payments to help you money, the reduced their auto loan cost will tend to be.

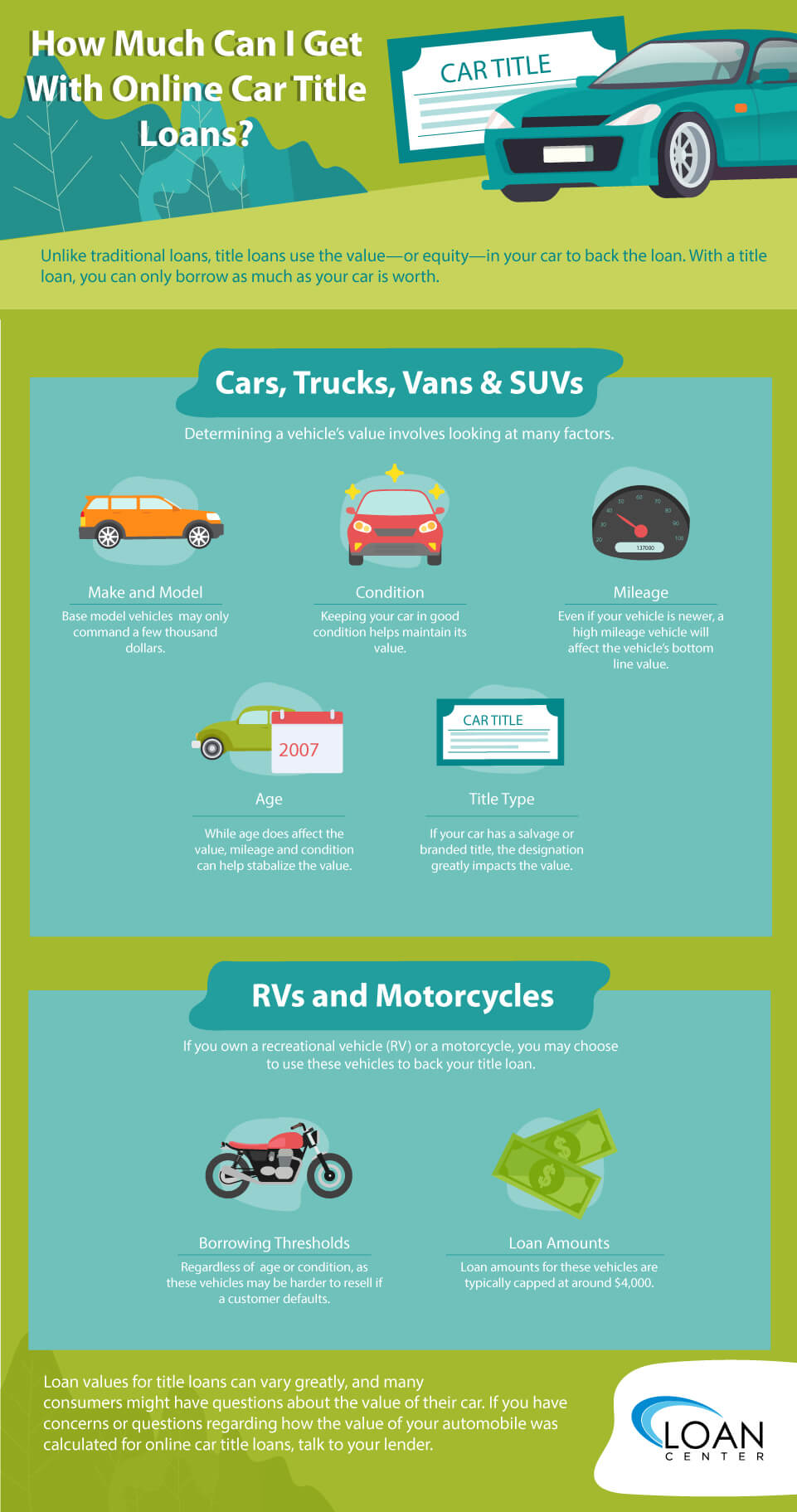

- Vehicle's many years and you can reputation : Loan providers routinely have decades, mileage and you may updates restrictions to have funded vehicles, as well as to improve pricing according to those individuals facts. Money for older, higher-mileage automobile or those who work in bad status include large interest rates.

Exactly what gets into your credit rating?

Fico scores was in fact widely used once the 1989, whenever FICO, hence already has got the most widely used rating model, brought their system. Fico scores are meant to tell lenders how probably youre and also make their expected costs timely and in full. Your own FICO credit history is founded on the five points below, which can be weighted in a different way.

Leave a comment