Their Mortgage broker Are going to be To you Every step of your own Means

Three-Date Review Several months

You will end up provided the loan Revelation document at the very least three days prior to the closing. This should give you generous for you personally to comment this new terms of their loanpare what exactly to people placed in your loan Imagine. Any high alter made to your loan Disclosure file requires the three-big date opinion months so you're able to reset.

For example, the latest remark period usually reset in case your Apr on the a predetermined rate financing change from the over step 1/eighth out-of a per cent or if perhaps the newest Apr on a varying speed mortgage alter because of the over 1/last regarding a per cent. It is going to reset if your mortgage unit alone transform, such in the event the mortgage alter from fixed to help you changeable speed mortgage, or if good prepayment penalty is actually placed into brand new terms. Brief changes, including repairing spelling errors, cannot result in the remark several months to reset.

Closure Conference

The fresh closing conference 's the conference where the brand new marketing usually take place. You will need to sign multiple data to-do you buy. Particular data have a tendency to confirm the mortgage terms and conditions with your financial when you're other people tend to show brand new sale ranging from both you and the vendor. There are settlement costs you will need to pay once they weren't folded in the loan. The financial institution ought to provide you that have recommendations on precisely how to pay in their mind (whether it's to spend digitally prior to the closing conference otherwise to create a good cashier's glance at). Such closing costs become from payment fees so you can pre-paid off costs.

Be sure to give several types of ID, such as your driver's license and you may passport, with your individual checkbook degrees of training to invest for your slight variations in the newest projected balance which is due and you will the past amount you owe. The newest closing meeting is always to grab just about a few hours.

Closing Files

- The Closing Disclosure Part of the report about all of your loan terms. This includes just how much their monthly installments will be as really as simply how much your closing costs might possibly be.

- The fresh Promissory Mention The fresh new promissory note is the legitimately joining contract that you'll pay off the loan. It includes simply how much the loan is for and you may precisely what the regards to the loan was. Additionally has the fresh recourse that the lender usually takes in the event the you never pay-off the borrowed funds (eg foreclosing in your domestic).

- Brand new Action from Faith The fresh new action from believe secures the newest promissory note while offering new bank with a declare up against your property if you Cos Cob loans don't meet the new regards to the mortgage.

- The fresh new Certificate off Occupancy If your house is the fresh new, needed a certification out of occupancy to disperse in.

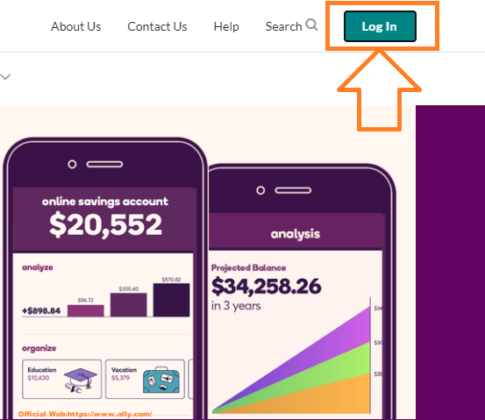

Through to basic glance, the borrowed funds techniques may seem a while difficult, especially when you see the reality that it is as a consequence of three each person (financial, financing chip, and you will underwriter) earlier might be acknowledged. not, the lender (referred to as the mortgage broker) will help show you each step of method. They can look at your credit file and you may money on the very beginning and you can show whether or not you'll qualify for particular home loans or perhaps not so that you would not waste time checking out the entire process merely to end up being refuted. They will also have qualified advice about you could improve your condition to be eligible for certain loans otherwise enhance the terms and conditions toward certain fund as well.

And make An offer

- Jumbo Funds Jumbo money was a type of low-compliant old-fashioned loan. It meet or exceed the loan restrictions founded by Federal national mortgage association and you will Freddie Mac, for example what's needed are much far more strict. Jumbo Money are used for costly features.

With that in mind, listed here are three essential elements of the brand new closure procedure that you should be aware of:

Leave a comment