Impairment Accounting Definition, Factors, Pros, Cons

In other states, chiropractors, as well as physicians, are free to provide impairment ratings on any body system (eg, a psychiatrically, hematologically, oncologically, or neurologically related rating). We also found that substantial lifestyle changes were required to stop the progression establishing and managing a service center mit office of the vice president for research of MCI in these patients. In the primary analysis, this ranged from 71.4% adherence for ADAS-Cog to 95.6% adherence for CDR-Global to 120.6% adherence for CDR-SB. In other words, extensive lifestyle changes were required to stop or improve cognition and function in these patients.

What's the difference between 'fascism' and 'socialism'?

These include unhealthful diets, being sedentary, emotional stress, and social isolation. Every human being is equipped with a unique set of strengths and weaknesses that enable them to do some things effortlessly but struggle in other areas. Although people with learning disabilities have some challenges with learning, they are not in any way inferior to anyone else. Special education, treatment, support, kindness, and patience can help them achieve success.

Availability of data and materials

Prior to conducting an impairment rating, physicians should thoroughly study the AMA Guides. When performing an impairment rating with the AMA Guides, the most important thing to remember is that the key elements required by the AMA Guides must be fulfilled; if they are not, the rating is not considered complete or accurate. Originally published as a series of articles in the Journal of the American Medical Association (JAMA), the AMA Guides have been revised periodically. They are a sometimes inaccurate, but nevertheless standardized, tool that can be used to convert medical information about permanent impairments into numerical values.

Overview of impairment rating

Various organizations offer training and certification in the process of impairment rating. These training courses describe the methods to be used in applying the AMA Guides. Although not required, such training is becoming increasingly more valuable because of the inordinate complexity of the AMA Guides. In short, a claims examiner and doctor/psychologist team has reviewed the evidence and determined the claimant was not eligible for disability benefits per SSA criteria. Then, an appeal was filed and a new claims examiner doctor team was assigned and reviewed the evidence (including any new evidence) and still found the claimant not disabled.

Accounting software

However, the recovery amount is limited to the cumulative recognized impairment losses, which means companies are not allowed to expand their balance sheets by matching the carrying amounts to higher market values. An impairment in accounting means that the value of a company asset has diminished to less than its book value. Recording impairment on financial statements is a requirement under the US Generally Accepted Accounting Principles (GAAP). Accounting for impairment in the financial statements ensures the accurate valuation of a company’s fixed and intangible assets.

If participants in both groups made similar lifestyle changes, then it would not be possible to show differences between the groups. Caution should be exercised when symptoms alone are used to establish the existence of permanent impairment. For example, the SSA rules state that such a determination should never be made based only on symptoms.

In complex cases, the fee structure should be negotiated in advance to avoid misunderstandings. From an ethical point of view, the examining physician should provide an honest examination of the individual; the physician's opinion should not be dictated by the referral source. Most reports should contain a statement of the residual functional capacity or, in some cases, the specific functional imitations of the individual. This determination is usually necessary for proper vocational decisions to be made. The information allows rehabilitation counselors and others to make the best determination of the type of job that the person is fit to perform. In an ADA analysis, the information can be used to match capability with essential job functions.

For example, comparing these results to those of the MIND-AD clinical trial provides more biological plausibility for both studies [44]. Impairment refers to a loss or abnormality in body structure or function, such as a physical or mental condition that affects a person's ability to perform certain tasks. It is a medical or biological term that focuses on the individual's physical or mental limitations. On the other hand, disability is a broader term that encompasses the social and environmental barriers that individuals with impairments face in their daily lives. It refers to the restrictions or limitations imposed on a person's ability to participate fully in society due to their impairments. Disability is a social construct that recognizes the impact of societal attitudes, policies, and physical environments on individuals with impairments.

- When the book value of an asset is greater than the undiscounted cash flows that the asset is expected to generate, the book value is considered non-recoverable, and an asset impairment should be recognized.

- Participants in both groups completed a follow-up visit at 20 weeks, where clinical and cognitive assessments were completed.

- Unlike workers' compensation, an individual need not be injured on the job to receive disability insurance benefits; one can qualify for compensation after being disabled by an automobile accident or by cancer.

- This decision was based only on recruitment issues and limited funding, without reviewing the data at that time.

- As you write about the impairment, you'll want to be brief and clear, but you'll also want to include important details.

If the asset can be sold at $30,000 with zero selling cost, the recoverable amount will be $30,000. With a carrying amount of $38,000, the asset will be written down by $8,000, and an equal amount of impairment https://www.bookkeeping-reviews.com/ loss will be recognized. Long-term assets, including fixed (e.g., PP&E) and intangible (e.g., patents, licenses, goodwill) assets, are subject to asset impairment as a result of their long economic lives.

When the asset is sold at the market value after several years, the company will realize a large loss. Instead, if the company records impairments periodically, the book value of the asset will better align with the market value, and the large loss will instead be recognized over several impairment losses. The impairment loss is entered as a write-off so that the asset's real value is reflected on the balance sheet and it’s not overvalued. The fair market value is the amount the asset could be sold for in the current market. Another way to describe this is the future cash flow of the asset or how much cash it could generate in ongoing business operations. Sometimes, a patent may be impaired and not worth the amount shown on the balance sheet.

Enrolled Agent EA Salary Guide

The Internal Revenue Service, in an effort to satisfy legal requirements, confers the status of enrolled agent to qualified candidates. An individual who has been certified as an enrolled agent is then allowed to serve as an intermediary for private businesses and citizens in relation to tax questions and disputes. Enrolled agents are typically employed by businesses specializing in handling income tax https://www.aviation-flight-schools.net/pennsylvania-aviation-schools.htm resolutions or preparing tax returns. The biggest step you can take to increase your salary as a tax preparer is to become an Enrolled Agent. Entry-level tax preparers make less, but can expect their salary to increase after gaining several years of experience, and gathering more clients. If you don’t currently have the IRS experience to become an enrolled agent, you’ll need to pass the EA exam.

Enrolled Agent vs CPA

At a median of over $53,000, the salary for an independent enrolled agent is not bad. Furthermore, when you consider the lack of an upper limit on your earning potential, the idea of self-employment becomes very attractive. In the right area, and with the right book of business, an enrolled agent can do quite well working in self-employment. Best of all, you can set your own schedule, work across the United States, and take on as many clients as you can keep.

Highest paying enrolled agent jobs

Agents with more than 20 years of experience may see a pay raise up to $60,000 per year. Becoming an EA is one of the best investments you can make in your career as a tax preparer. The benefits you’ll gain from earning the EA designation will far outweigh the cost of taking the EA exam. In addition to the salary benefits, you’ll also enjoy increased representation rights so you can expand your client base and the services you can offer. Plus, the EA designation signals a high level of expertise that will cement your status as a valuable expert on tax topics. Self-employed enrolled agents who operate their own accounting agencies can expect more earnings than their counterparts at large brokerages and corporations.

Average enrolled agent salary

So, to determine how lucrative a career as an enrolled agent can be, use this information to learn more about the https://logoburg.com/page346480.html. The Enrolled Agent (EA) credential is a nationally recognized certification offered by the IRS for tax professionals. There is no specific education or work experience requirement, although candidates should have well-established tax knowledge before taking the exam. As their experience increases, these agents have the opportunity to move up the pay scale.

- In order to become a certified public accountant, candidates are required to complete a minimum of 150 undergraduate hours.

- CPAs, on the other hand, are public accountants who file reports with the Securities and Exchange Commission (SEC).

- Yet, in the mile-high city, over half of the EA salary figures posted are above $112,000 annually.

- Preparing your own income tax return can be a task that leaves you with more questions than answers.

- Compare enrolled agent salaries for individual cities or states with the national average.

Steps to Earn the IRS Enrolled Agent Salary

Compare enrolled agent salaries for cities or states with the national average over time. The National Association of Enrolled Agents reports that there are more than 50,000 enrolled agents working in the United States as well as abroad. Before delving too deeply into this field as a career option, it’s important to understand EA salaries to determine if this is the right career choice for you. The ideal candidate to be an enrolled agent is someone who is detail oriented and enjoys delving into the continually changing nature of tax laws. Individuals who are considering becoming enrolled agents should enjoy working with people and have high ethical standards.

Who should earn the EA?

After-the-Fact-Payroll ServicesWe will take your manually-prepared payroll records and other payroll information and post this information to our data files, so you get... Comprehensive Payroll ServicesOur Comprehensive https://www.sviatky.ru/svjury/99-regulfestival.html Payroll Service takes care of all of the payroll processing for you, so that you won't have to. If you'd like to receive more information about our Tax Preparation Service, please complete this form.

- Furthermore, when you consider the lack of an upper limit on your earning potential, the idea of self-employment becomes very attractive.

- Before delving too deeply into this field as a career option, it’s important to understand EA salaries to determine if this is the right career choice for you.

- By comparison, a CPA can have a number of opportunities for earning money.

- Many EAs chose to work for large agencies, accounting or otherwise.

- The main service that distinguishes an enrolled agent from others is the ability to represent taxpayers.

- In the last few years, IRS examinations or audits have increased significantly.

After passing the exam and paying the necessary enrollment fee, candidates will then be required to pass a compliance check to ensure they have paid all their taxes. EA candidates are not allowed to have any outstanding tax liabilities. Candidates who have a sufficient amount of work experience, according to IRS guidelines, may not even be required to take the exam. An entry-level enrolled agent with up to five years of experience can typically expect to earn an average of $42,000 per year.

In most cases, enrolled agents compete with other tax professionals. Many EAs chose to work for large agencies, accounting or otherwise. However, some prefer to work for only one client or for a corporation or a smaller business.

Chicago’s median salary for enrolled agents is actually lower than that of the rest of the country, according to Payscale’s data. Current job postings in Chicago reveal an EA salary range from around $55,000 per year to over 6 figures. What’s more, the median pay for enrolled agents in Denver is in line with the U.S. median at almost $54,000.

In Depth Look At Homeowners Association Accounting CSM

Whether it's meetings, inspections, Rules and Regulations, or budgeting and accounting, our experienced Consultants will collaborate closely with your Board of Directors to maximize the benefits of our expertise. What sets us apart is our flexibility; we offer the option to spread payments over three months to provide your Board accounting for homeowners associations with financial flexibility. We want to help you create a tailored package that perfectly suits your association's requirements. This could be either your HOA management company or a Certified Public Accountant (CPA). A comprehensive audit involves the checking of records to ensure they comply with basic accounting principles.

Statement of Income & Expense

Just as good accounting can simultaneously make HOA board members’ jobs easier and help their organizations perform better, failures of accounting or financial reporting can prove both time-consuming and damaging. Tracking down a financial error in HOA financial statements based on paper records or offline spreadsheets can take days, frustrating board members and raising questions. The HOA board is ultimately responsible for maintaining community standards, but board members often hire an outside association management company to be the rule enforcer. The management company will likely be charged with visiting the community to monitor compliance, sending notices to homeowners in violation, and assessing and collecting fines. The board may opt to hire an accountant to maintain the books and prepare the reports.

How does an HOA enforce rules?

You also need a software that is easy to use, will do exactly what you need it to do and is budget-friendly. Since the nature of your association requires collecting regular fees from its members, the recurring invoice feature from FreshBooks allows you to plug in your members’ information once. You can also plug it in along with the amount of the fee and the monthly or annual due date.

How do I find my HOA’s rules?

- Doing this ensures that all the information will be completed in a timely manner.

- As a member of your association’s Board of Directors, it’s your job to know and understand these key financial concepts and safeguards, in order to better protect your community’s funds and properly serve your fiduciary duty.

- Reading and understanding this complete guide to HOA financial management will help you and your team improve your bottom line, accelerate growth, and bolster homeowner confidence in your community association leadership.

- For example, under California law, the Association’s Reserve Account must be a separate fund from the operating account.

- HOA rules and regulations can be changed with the power of a community meeting and board vote.

- The HOA Portal makes it simple for homeowners to access documents and their payment history.

An example would be to ensure that neither the accounts payable department (the person who writes the checks) nor the accounts receivable department (the person who enters the money received) reconcile the bank statement. As you may well know, being a member of the Board of Directors for your homeowners association means having an immense financial obligation to your community. Your job will become convoluted by illegible or inaccurate https://www.bookstime.com/ financial reports and records, which—if you are not prepared—can be overwhelming. No matter who prepares the HOA accounting reports, using the right software is pivotal. CINC’s accounting software offers integrated banking features and repetitive task automation. These tools increase transparency among board members, residents, and the management company through timely, accurate, and frequent HOA accounting reports.

- The beginning and ending balance shown by your bank should match what your accounting system shows.

- The reconciliation process ensures that the bank account balance in your real estate accounting system is the same as what the bank shows.

- Under the accrual basis of accounting, all HOA financial activities are reported on the financial statements.

- Think about it – an HOA has to collect assessments from anyone who owns property inside of the area that it controls; the HOA has no control at all over who buys this property.

- Balance Sheet-The financial statement which shows the amount and nature of business assets, liabilities, and owner’s equity at a specific point in time.

- Accurate minutes are legally mandated records of HOA decisions, fostering trust and accountability among board members.

How can you change HOA rules and regulations?

An accounting standard is a set of procedures, policies, and principles specifying how accounting transactions must be recorded and reported. In the United States, the most commonly used set of accounting standards is the Generally Accepted Accounting Principles (GAAP). The ideal tech option will be designed from the ground up for the HOA space and available as part of a comprehensive community management suite. Empowered with this solution, HOA board members can step up their accounting performance without retraining themselves to become accountants.

Remote HOA Management

Using the accrual basis, the association reports revenue when it earns them, regardless of when money actually changes hands. HOA accounting is an important aspect of running a homeowners association, but it can be a tedious task. Board members have a responsibility to understand financial interim statements to guide the association’s financial course. This job can be complicated by inaccurate or incomplete financial reports.

Subscribe to get our top real estate investing content.

When choosing an accounting software for your homeowners association, there are a few things to consider. At ACCU, Inc., we recognize that HOAs often require assistance but are unsure where to turn. Attorneys can be costly for a check-up, and other management companies may push for complete management contracts.

Top 4 Tips for Using an Integrated Banking System

Why is great HOA accounting so important to communities and management companies?

Basic Earnings Per Share EPS: Definition, Formula, Example

Typically, this consists of adding or removing components of net income that are deemed to be non-recurring. However, assume that this company closed 100 stores over that period and ended the year with 400 stores. An analyst will want to know what the EPS was for just the 400 stores the company plans to continue with into the next period.

- Earnings per share is an important metric used by investors and analysts to evaluate a company's financial performance.

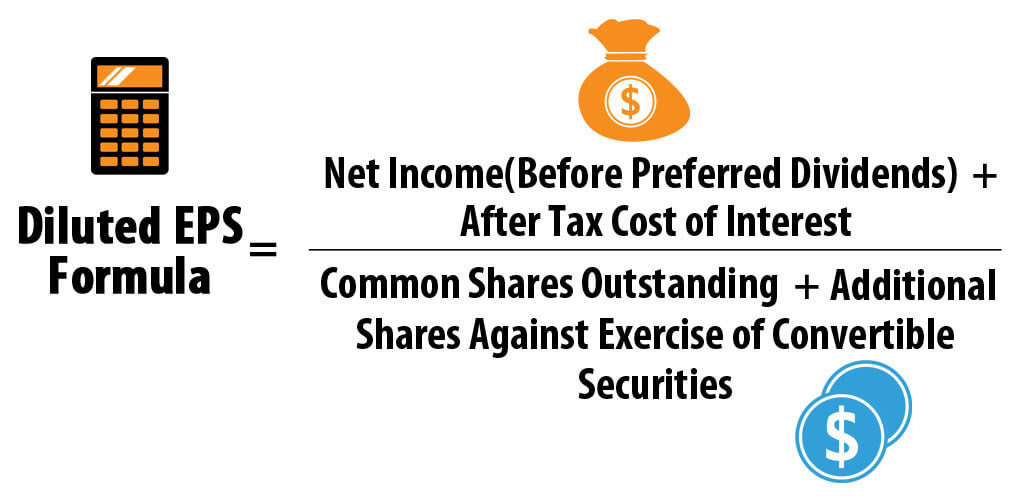

- On the other hand, diluted EPS accounts for the potential dilution of outstanding shares.

- Diluted EPS is calculated by dividing the $10 million in net profit by the 10.5 million in diluted shares, giving a result of 95 cents.

- As mentioned before, a good EPS growth rate is over 15%, and it will usually be preceded by a higher revenue growth rate.

- For a company, showing high EPS relative to its share price can attract new investors that can fund expansion projects and make the company earn even more money.

- If significant dilutive securities are in circulation, diluted EPS may give a more accurate representation of the company's earnings potential.

Sales & Investments Calculators

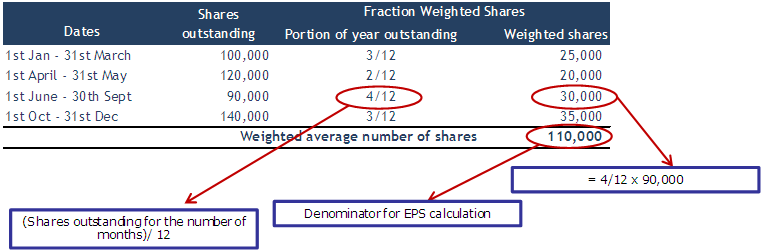

Basic EPS and diluted EPS are used to measure the profitability of a company. The amount earned by each share of common stock is represented as basic earnings per share in the company income statement. The higher the company's basic earnings per share, the greater the return on investment and profit common stockholders make.

Earnings Per Share (EPS): An indicator of a company's profitability

The earnings per share growth calculator is a fundamental tool in your investment strategy. By understanding and using the earnings per share growth and the EPS growth rate, you can spot great investment opportunities that can return 100% or more. In this article, we will explore what EPS growth is, how to calculate the EPS growth rate, and see a real example of what is a good EPS growth rate. Earnings per share is an important metric used by investors and analysts to evaluate a company's financial performance. It can be calculated using different methodologies, which is important to keep in mind when comparing companies across industries. Basic EPS is calculated by dividing a company's net income by the number of its outstanding shares.

Diluted Earnings Per Share Calculation Example (EPS)

The net earnings of a company in a given period – i.e. net income (the “bottom line”) – can either be reinvested into operations or distributed to common shareholders in the form of dividend issuances. The earnings per share (EPS) is the portion of a company's total profit allocated to each of the shares held by the company's shareholders. It is one of the most important variables used to determine the profitability of investing in a given stock. The earnings per share figure is especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. A higher EPS means a company is profitable enough to pay out more money to its shareholders. For example, a company might increase its dividend as earnings increase over time.

In that event, the higher diluted share count is making the business look better than it might otherwise be. The accounting rules applied to diluted shares aim to prevent that outcome. Investors have a vast collection of financial data and indicators to use when selecting stocks, and one of the most common ratios used is earnings per share or EPS. But the EPS calculation can be tedious, especially if you aren't sure of the formula.

What Is the Formula for Calculating Earnings per Share (EPS)?

EPS stands for earnings per share, which is the amount of a company’s net earnings per share of outstanding stock. It’s important to remember that EPS figures can’t really be compared across companies. Earnings per share shows up on the profit and loss statement; book value (also known as shareholders’ equity) on the balance sheet. It’s worth noting that not all potential equity stakes are included in the diluted share count or in diluted EPS.

But in actuality, stock splits and reverse splits can still affect a company’s share price, which depends on the market’s perception of the decision. Suppose we’re tasked with calculating the earnings per share (EPS) of a company that reported $250 million in net income for fiscal year 2021. It is a widely used metric to analyze the performance and profitability of different companies.

Diluted EPS, on the other hand, reflects the potential dilution that could occur if convertible securities or options were exercised. For example, if a company makes 8 dollars per share instead of 10 USD, which it could have quickly paid out, then the $2 withheld from each shareholder is considered retained earnings per share. This implies that preferred shareholders do not have the ability to vote for the social security 2021 board of directors or a corporate policy. If a company ever has to liquidate, common shareholders are the last group of people who can make claims. From an investment standpoint, common stockholders usually profit more handsomely in the long run. This means that as a shareholder, you are entitled to part of the company's profits through dividends and increased value if the company's overall worth rises.

When the EPS growth rate is low (under 2%) or the company has reported consecutive negative EPS, there is no sense in calculating the growth rate. As an option, we recommend you verify operating earnings growth with the operating cash flow calculator. That is because a positive and growing operating cash flow usually indicates a positive and solid EPS in the short term. Then, you can use such values (for example, 2020 EPS value and 2019 EPS value) and calculate its variation in our robust earnings per share growth calculator. Do not worry; we will explore how to calculate them in the following paragraphs. Such companies generally compute both basic and diluted earnings per share to ensure that investors have all the information they need about the company's profits.

Kudzu Root Extract Does Not Perturb the Sleep Wake Cycle of Moderate Drinkers PMC

There’s not a recommended dosage for kudzu root, but there have been human studies that can help guide you. This product may adversely interact with certain health and medical conditions, other prescription and over-the-counter drugs, foods, or other dietary supplements. This product may be unsafe when used before surgery or other medical procedures. It is important to fully inform your doctor about the herbal, vitamins, mineral or any other supplements you are taking before any kind of surgery or medical procedure. A prior study of kudzu to treat alcohol use in an outpatient setting reported that kudzu had no effect on maintaining sobriety or altering alcohol craving (Shebek and Rindone, 2000).

- Kudzu can be taken in conjunction with other medications for alcoholism, but it is important to consult with a healthcare professional before combining treatments.

- Synthetic versions of this selective ALDH-2 inhibitor are being investigated as potential medications to suppress relapse in abstinent alcoholics.

- However, it does not make people feel more drunk, or affect their physical abilities or mental agility.

- If you’re not sure whether kudzu root is right for you, talk with your doctor.

- No competing financial interest exists for Bethany K. Bracken, David M. Penetar, R. Ross Maclean, or Scott E. Lukas.

- Using the continuous measure of alcohol consumption, drinking was quantified using a number of different variables as noted above.

Vitacost Kudzu Root Extract

However, these authors noted that there was a large dropout rate, subjects were not supervised while they completed the questionnaires, and there was only a single assessment each month. All of the above factors may have contributed to the negative findings of this study. One study in mice found that kudzu vine extract was highly beneficial in treating alcohol-induced liver damage by scavenging harmful free radicals and boosting the natural antioxidant system (6).

May alleviate menopausal symptoms

- Kudzu Root, an herbal remedy gaining popularity in the wellness community, is known for its wide range of health benefits.

- A total of 21 adult males (17 Caucasian, 1 African American, 2 Hispanic, 1 Middle Eastern; mean age 23.8 ± 3.46 years, range 21–33) were recruited through advertisements in local and college newspapers and flyers posted in the Boston area.

- While you can find kudzu vine almost anywhere in the South by taking a drive on a country road, kudzu root is probably most popular by way of a supplement or as kudzu root tea that can be found at most health food stores.

- Kudzu Root is rich in phytoestrogens, which are plant-based compounds that mimic the effects of estrogen in the body.

Furthermore, it’s likely that the suggested doses for kudzu root will vary depending on the manufacturer and the type of supplement you may be considering. There isn’t much scientific evidence available on the dosing for kudzu root as a supplement. For this reason, it’s difficult to make recommendations for various uses. Small studies in people have observed noteworthy improvements in these menopausal symptoms, among others, like vaginal dryness (9, 10). Kudzu root is rich in antioxidants, compounds that protect cells from oxidative stress that can lead to disease. The isoflavone puerarin is the most abundant antioxidant compound in the kudzu vine (6).

Health Challenges

The kudzu plant resembles poison ivy, so it’s important to know how to identify it correctly. Antioxidants help neutralize these molecules, reducing the risk of oxidative stress and related health problems.

- 'Perfectly safe'In 2003, David Overstreet and other scientists found the herb to be effective in reducing alcohol intake on rats.

- A bottle offers a 100-day supply, supporting peak health for three months.

- While scientific research on kudzu’s effectiveness in addressing alcoholism is limited, some studies have shown promising results.

- There is some evidence that kudzu root dietary supplements may cause liver injury.

Decreased drinking due to ALDH-2 inhibition is attributed to the aversive properties of acetaldehyde accumulated during alcohol consumption. However, daidzin can reduce drinking in some rodents without necessarily increasing acetaldehyde. A standardized formulation of kudzu extract produced minimal side effects, was well-tolerated, and resulted in a modest reduction in alcohol consumption in young nontreatment-seeking heavy drinkers. Additional studies using treatment-seeking alcohol-dependent persons will be necessary to determine the usefulness of this herbal preparation in reducing alcohol use in other populations.

PLANT DISEASES CAUSED BY PARASITIC HIGHER PLANTS, INVASIVE CLIMBING PLANTS, AND PARASITIC GREEN ALGAE

Finally, kudzu root extract did not affect sleep quantity as measured by the number of sleep episodes, the time asleep per episode, and the time spent immobile (Fig. 3). A study published in Psychopharmacology involved four weeks of treatment of best kudzu for alcoholism 17 men ages 21–33 years old. These men reported drinking 27.6 ± 6.5 drinks/week with a diagnosis of alcohol abuse and/or alcohol dependence. They consumed either kudzu extract or matched placebo on a daily basis. As drinking behavior was measured using a wrist actigraphy device, we were able to monitor alcohol consumption continuously, 24 hours a day and seven days a week.

The 20 Best Online Bachelors in Accounting Degrees

A school may offer its bachelor’s in accounting programs in person, online or in a hybrid format. Coursework for a bachelor’s degree in accounting usually includes a healthy dose of business and math. Algebra, calculus and statistics coursework helps build solid mathematical skills to support a numbers-heavy accounting career.

Saint Mary-of-the-Woods College

Forensic accountants and fraud examiners can help tip the scales of justice in legal cases such as asset misappropriation, tax fraud and corporate corruption. They help provide accounting firms, law offices and government agencies the evidence they need to uncover, assess and prosecute theft in both criminal and civil offenses. Plus, the accelerated pathway can help you satisfy the 150 credits required to sit for the CPA exam in most states even faster, for less. AI can count the beans now — but it can't provide the insight and analysis that expert accountants have to offer. Well-trained, thoughtful accountants and auditors are more valuable than ever.

Credit for prior learning

The Bureau of Labor Statistics stated that the median annual wage for business and financial occupations in 2021 was $76,570, much higher than the median yearly wage for all occupations at $45,760. Earning a CPA credential can expand your career potential and set you apart from other accounting professionals. 91% of alumni report that FlexPath allowed them to use their knowledge and experience to move faster through their programs. If you have an interest in numbers and strong analytical skills, a career in accounting can be a good fit for you. Motivated individuals with accounting backgrounds often enjoy strong potential for career-long growth, including opportunities to step into highly paid positions with significant responsibility.

Accounting Technical Requirements

Students must enroll in ACG and ACG during their first semester within the Accountancy and Analytics major. Students are also required to complete at least one of these two required courses successfully with a grade of C (not C-) or higher on the first attempt. Students who are unable to pass both courses on the first attempt are assigned for major reselection. https://www.bookstime.com/ Enroll in a business administration program and maximize your professional potential. According to the BLS, the median annual wage in 2021 for management occupations was $102,450 — the highest salary of all major occupational groups. In 2021, the Bureau of Labor Statistics (BLS) reported that accountants and auditors made a median annual wage of $77,250.

Is a bachelor’s degree in accounting worth it?

- Hybrid learning blends in-person and online instruction, which may occur asynchronously or synchronously.

- Trine University in Fort Wayne, Indiana, offers an ACBSP-accredited online BSBA in accounting from the College of Graduate and Professional Studies.

- The best bachelor's degree for an accountant covers topics such as finance, mathematics, and business.

- Students with previous coursework can complete their degrees in fewer than four years.

- Though many colleges and universities are becoming test-optional, some programs may want to see SAT scores for accounting students.

These online bachelor's degree programs can be a great option for students who are working full-time so they can continue to pursue their online education while still earning money. The baccalaureate program also prepares students for entry into the Master of Accountancy (M.Acc.) professional degree program. The State of Florida requires completion of 120 semester hours to sit for the CPA examination and 150 semester hours are required for licensure. In the accounting specialization, students acquire and apply various methods of ethically maintaining accurate and up-to-date financial records and reporting procedures for business transactions. Students also gain and practice an understanding of a wide array of accounting-related services, including budget analysis, financial and investment planning, and financial statement and internal control auditing.

Progression Requirements - Muma College of Business

An online bachelor's degree program will be a crucial first step in preparing for CPA certification. When researching an online accounting degree, you'll need to ensure that your online degree is from an accredited institution. An online accounting degree is extremely valuable if you want to become an accountant. This will help you learn about fundamental accounting principles, rules, regulations, financial statements, and more. And if you want to become a CPA you'll absolutely need at least a bachelor's degree, if not a master's degree.

- Most full-time students take four to five years to complete a program, while part-time learners may need more time.

- This applies both to continuing USF Accountancy and Analytics majors, as well as Accountancy and Analytics major courses transferred in from other institutions.

- Eastern New Mexico University’s 100% online accounting B.B.A. is delivered both synchronously and asynchronously.

- The curriculum consists of courses such as Intermediate Accounting, Individual Taxation or Business Taxation, Accounting Analytics, and others.

- Understanding the benefits of an online BS in business management, where can the diploma lead?

#12 Washington State University Washington State University Washington State University Washington State University

- A bachelor's degree in accounting is a four-year undergraduate program, typically comprising around 120 credits.

- Find the best online schools offering forensic accounting degrees in 2023 based on each program's popularity among online students.

- Mercer's online BBA in accounting makes it easy to launch your journey toward an accounting career.

- The curriculum covers data communication and interpretation and can prepare students to take the CPA exam by the time they graduate.

- This digital world offers many more learning opportunities than we had years ago.

Employees of Purdue Global partner organizations may be eligible for special tuition reductions. Budget analysts’ job duties include preparing budget reports, tracking spending and making budget recommendations. Analysts in government jobs may also give input on policy considerations and legislation. Through case studies and problem sets, instructors will demonstrate how to design, apply, and evaluate an audit. Topics may include common audit standards, tests and controls, and statistical samplings.

Accreditation for Online Bachelor’s in Accounting Degrees

The total rewards perspective integrates tangible rewards (e.g., salary, bonuses) with employee benefits (e.g., health insurance, retirement plan) and intangible rewards (e.g., location, work environment). This perspective allows students to use all forms of rewards fairly and effectively to enable job satisfaction and organizational performance. You can still gain general admission to most online programs at ASU through Earned Admission. Through this pathway, you can demonstrate your ability to succeed at ASU by completing online courses with a 2.75 GPA or higher.

Should You Enroll in an Online Bachelor’s in Accounting Program?

Learn about start dates, transferring credits, availability of financial aid, and more by contacting the universities below. Graduates of this program are ready to progress toward a MAcc program, CPA examination, or a specific job. WGU's accounting bachelor's program is a crucial step in eligibility to sit for the accounting business accounting certification exam, and prepares you for success in the field. Business Ethics is designed to enable students to identify the ethical and socially responsible courses of action available through the exploration of various scenarios in business. Students will also learn to develop appropriate ethics guidelines for a business.

Though many colleges and universities are becoming test-optional, some programs may want to see SAT scores for accounting students. Admissions departments also commonly require you to submit a letter of recommendation and a personal essay, along with a resume or CV detailing relevant professional experience. Accreditation is a process through which third-party organizations evaluate institutions (and their programs) for student resources, curricular offerings, and graduation outcomes. Prioritize accredited schools, as they have demonstrated that they meet industry-wide standards. Schools may also accept transfer credits from applicants' past educational institutions to cover general education classes and other courses. However, these applicants' former schools must be accredited in order for the new institutions to accept and honor the transfer credits.

Retained Earnings in Accounting and What They Can Tell You

As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company. Retained earnings Certified Public Accountant are left over profits after accounting for dividends and payouts to investors. If dividends are granted, they are generally given out after the company pays all of its other obligations, so retained earnings are what is left after expenses and distributions are paid.

Income statement sample

Beyond this, retained earnings are also a useful figure for linking the income statement and balance sheet. As a result, additional paid-in capital is the amount of equity available to fund growth. And since expansion typically leads to higher profits and higher net income in the long-term, additional paid-in capital can have a positive impact on retained earnings, albeit an indirect impact. A big retained earnings balance means a company is in good financial standing. Instead, they use retained earnings to invest more in their business growth. Retained earnings refer to the cumulative positive net income of a company after it accounts for dividends.

Are Retained Earnings Current Liabilities Or Assets?

Retained earnings for a single period can reveal trends in the company’s reinvestment, but they don’t tell you how those funds are used, or what the return on investment is. Looking at retained earnings can be useful, but they’re more valuable when observed over a longer period of time. Declared dividends are a debit to the retained earnings account whether paid or not. Now that you’ve learned how to calculate retained earnings, accuracy is key. The purpose of a balance sheet is to ensure all your bookkeeping journal entries are correct and every penny is accounted for. However, company owners can use them to buy new assets like equipment or inventory.

- Paying off high-interest debt also may be preferred by both management and shareholders, instead of dividend payments.

- Additional paid-in capital is included in shareholder equity and can arise from issuing either preferred stock or common stock.

- It is a key indicator of a company's ability to generate sales and it’s reported before deducting any expenses.

- For example, a company may pay facilities costs for its corporate headquarters; by selling products, the company hopes to pay its facilities costs and have money left over.

- Both are required to judge a company's financial health but don't reveal the same thing exactly.

- Retained earnings are a clearer indicator of financial health than a company’s profits because you can have a positive net income but once dividends are paid out, you have a negative cash flow.

- Owner’s Equity is the owner’s investment in their own business minus the owner’s withdrawals from the business plus net income (or minus the net loss) since the business began.

What Is the Difference Between Retained Earnings and Net Income?

This action merely results in disclosing that a portion of the stockholders' claims will temporarily not be satisfied by are retained earnings an asset or liability a dividend. Owners of stock at the close of business on the date of record will receive a payment. For traded securities, an ex-dividend date precedes the date of record by five days to permit the stockholder list to be updated and serves effectively as the date of record. The last two are related to management decisions, wherein it is decided how much to distribute in the form of a dividend and how much to retain.

And it can pinpoint what business owners can and can’t do in the future. The act of appropriation does not increase the cash available for the acquisition and is, therefore, unnecessary. It may be done, however, if management believes that it will help the stockholders accept the non-payment of dividends. Up-to-date financial reporting helps you keep an eye on your business’s financial health so you can identify cash flow issues before they become a problem.

- And it can pinpoint what business owners can and can’t do in the future.

- A statement of retained earnings details the changes in a company's retained earnings balance over a specific period, usually a year.

- Where profits may indicate that a company has positive net income, retained earnings may show that a company has a net loss depending on the amount of dividends it paid out to shareholders.

- On the other hand, though stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock.

- But with an effective budget, you can prepare for the dips by making the most of your peaks.

- It reveals the "top line" of the company or the sales a company has made during the period.

- The formula to calculate retained earnings encompasses those elements.

Step 1: Prepare the Statement Heading

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible.

How to Use QuickBooks to Manage Your Business’ Finances

From expense management to QuickBooks cash flow forecasting, you can choose a selection of apps that will streamline your processes and make it easier to stay on top of your business finances. QuickBooks, on the other hand, is a software dedicated only to accounting. It has features required https://www.personal-accounting.org/ specifically for accounting like income and expense tracking, payroll management, invoicing and inventory management. While setting up QuickBooks, you can connect your bank as well as credit card accounts to the software. Once done, QuickBooks tracks your bills and expenses automatically.

How long does it take to learn QuickBooks?

- QuickBooks is one of the most popular accounting software for small businesses in 2024.

- Don’t be intimidated by the size of the tutorial―take one lesson or tutorial at a time.

- Want to add more users to your account so you don’t have to do it all yourself?

- If you outgrow any service, you can choose to remove or upgrade it as needed.

- If you do get stuck, QuickBooks Online help is easily accessible from within the application, or you can check out the various QuickBooks Online training options offered by Intuit.

- QuickBooks excels in structuring financial data systematically.

For some charts, you can even compare your numbers to other businesses in your industry. QuickBooks boasts a range of tools that cover various aspects of Financial Management. From generating professional invoices to efficiently processing payrolls and accurately calculating taxes, these tools simplify https://www.kelleysbookkeeping.com/independent-contractor-tax-form-requirements/ complex financial tasks, ensuring compliance, accuracy, and efficiency. This is especially true if you use the online bank connection feature. Doing so can save a lot of time in managing transactions and receiving payments - as long as you use the bank connection (feed) feature properly.

How to set up and use the bank connection feature

Yes, these training tutorials are updated regularly based on the latest feature updates or changes made by Intuit, the company behind QuickBooks. Our free QuickBooks Online tutorials are comprehensive and educational resources designed to help you use QuickBooks Online for your business more effectively. Each course provides detailed step-by-step guides through a combination of comprehensive text instructions, practical examples, and video demonstrations. If you’re not sure where to start, take a moment to learn about the basics.

Managing Business Credit Card Transactions

You can browse the different categories in the app store, or if you know what you’re looking for, simply search for the app’s name. To add employees to your payroll, head to ‘Employees’ from your dashboard. Note that all employees will have the standard pay policies and deductions you’ve already set up, but you can also choose to add them when you add employees instead. You’ll be guided through the process as in this video below to set up their tax information, salary details, and other information like their pay schedule.

So, if you want to organise your finance or optimise your accounting practices, investing in learning QuickBooks can benefit you. QuickBooks Online also offers automated sales tax, because there are literally thousands of sales tax jurisdictions in the United States. Sales tax needs to be defined by jurisdiction such as state, county, and city. Once populated here, you can fiscal year and fiscal period then specify it for specific products and services in the appropriate form. In the sections below, you can learn how to set up and use specific features of QuickBooks as a first-time user. A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses.

QuickBooks Online Tutorial: A Beginner's Guide

Manual Accounting tasks that were once time-consuming are now automated, from transaction recording to account reconciliation. This streamlining not only saves time but also minimises the potential for errors, resulting in more reliable financial data. Unlock the power of merchant services for your business with our comprehensive guide.

Once you’ve added this information, head to ‘Accounting’ from the setup overview screen, then choose ‘Company and Account’. Head to ‘Bank Accounts’ on your dashboard and click ‘Connect account’, then search for your bank and sign in using the same username and password as you use for your online banking. Most banks will show transactions from the past 90 days, although some banks will let you go back as far as 24 months.

When you first visit the performance center, QuickBooks has built-in charts ready for you. Every business tracks unique metrics to measure its performance. Learn how to build charts to see your business performance in QuickBooks Online Advanced and QuickBooks Online Accountant.

However, as with any accounting software, there is a learning curve to mastering it. Beginners, though, can easily use the platform once they have learned the key features. You will need to add sales tax details if you sell products and services. As with the basic company information, this can be set to appear on all invoices and sales forms. For example, small businesses with international customers may choose to use QuickBooks Essentials, Plus, or Advanced. These subscription levels include the Multicurrency feature, which helps track international transactions.

To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. In this QuickBooks Online tutorial, we’ll cover some of the most common tasks you’ll be performing in QuickBooks Online, showing you just how easy it is to use. However you work, no matter what your business does, QuickBooks has a plan for you.

Excel is a spreadsheet program that you can use for multiple functions like creating databases, project management and, yes, accounting. However, creating a solid accounting database in Excel requires a thorough knowledge of how to set up spreadsheets and all the formulas that may entail. QuickBooks Online is available both as a desktop application and an online SaaS (software as a service) model. However, access to add-on services to the QuickBooks Desktop for Windows 2019 was discontinued after May 31, 2022.

Our free QuickBooks tutorial series starts with setting up QuickBooks Online for your business. By the time you complete this section, you will be ready to start using QuickBooks to manage all of your income and expenses. This covers how to create sales forms and track sales and income in QuickBooks Online.

How to Do Accounting for Your Construction Business 8 Steps

Discover how our tailored bookkeeping services can support your business growth and simplify your financial management. At Stratlign, we proudly serve businesses in construction and the trades as financial management partner. As you grow, we’ll provide the accounting and bookkeeping services that you need to manage your revenue and expenses while remaining compliant with all local, state and federal regulations. It’s especially useful for small construction companies that deal with longer-term contracts and transactions. The cash method of accounting for contractors is a system that records all cash transactions when they occur. This method is often used in construction accounting because it allows contractors to construction bookkeeping accurately track their cash flow and the progress of their projects.

How does accounting software improve productivity?

Most users report having an easy time navigating and using the Foundation software for their usual needs. Some people need help learning to use its more advanced features, though Foundation offers a highly-rated customer service line for assistance. To record a construction cost, debit the construction in the process column and credit the cash column. Companies that had client tracking, software integrations and mobile apps performed better than those that didn’t. This is why it has flexible billion options, such as American Institute of Architects, time and materials and freeform billing.

Understand Contract Retainage and Milestone Payments

Accounting software makes it easier to keep your records accurate, neat, and tidy. With accounting software, you simply enter the data and the software puts it where it needs to go. Construction has a unique type of payment structure that includes retainage, Retainage is the amount of money that clients withhold until they are satisfied with a project. When you have multiple projects going on, you need reliable and strong retainage management to ensure you have capital in case the client withholds the money.

Business Partnership Definition: Types, Advantages, and How to Start One

The term “balance sheet” originates from its purpose of balancing the contractor’s books, assessing both project and overall financial health. This report provides a clear overview of what the company owns, plans to pay out, and expects to earn, achieved by adding and subtracting numbers derived from liabilities and assets. With the balance sheet, businesses gain valuable insights into their financial position, enabling informed decision-making and strategic planning. For construction companies, adherence to industry regulations and taxes is vital to sidestep penalties and uphold a favorable reputation.

Why Is Construction Bookkeeping So Complicated?

Construction accounting also includes the management of accounts receivable and accounts payable, cash flow, and the reporting of financial information. This article will introduce construction accounting, including the key principles and techniques for managing your construction business. Most businesses simply record the cost of the products sold, but construction companies are quite different. Each job incurs direct and indirect costs that may fall into a wide range of categories. It’s essential that contractors have an effective method for keeping track of income and expenses, and for reconciling every transaction. Consider the cost of insurance, travel, workers’ compensation, materials, subcontractors, equipment, and more.

- Finally, you want to find a solution that you can customize if you have special reporting or processing needs.

- There may be an upfront deposit required, the project could be paid in full, or take months before getting full payment.

- Tools like FreshBooks allow you to customize and upgrade your plan as needed to ensure you’re always ready to take on more work.

- It’s also crucial to have clear payment terms with clients and ensure timely billing to maintain positive cash flow.

- If you’re considering purchasing new equipment or taking out a line of credit, for example, your accountant can help you determine the financial ramifications your decision can have.

- Classify your employees by compensation structure and track their hours diligently.

- Since construction accounting is project-centric, you’ll need a way to track, categorize, and report transactions for each job.

- Additionally, you should regularly back up your data to prevent any loss of information due to technical issues or cyber-attacks.

- Choosing the right accounting method for your construction company depends on your business needs and goals.

- You can go to a bank or credit union to set up a company checking account that suits the needs of your firm.

- Regarding accounting, Safe 300 breaks tasks down into assignments and work orders.

- Reconciling bank statements is an important task ensuring your records match your business account’s actual transactions.

With the right process, you can save time on your invoicing, accounting, bookkeeping, and tax preparation, even without previous construction accounting experience. Many construction companies use a “completion percentage” approach, meaning they calculate estimated taxes based on quarterly income and expense reports. https://blackstarnews.com/detailed-guide-for-the-importance-of-construction-bookkeeping-for-streamlining-business-operations/ You can use that bank statement to reconcile your transactions to make sure they match up with your own accounting system, invoices, payments, etc. FreshBooks contractor accounting software programs strike the ideal balance between ease of use and functionality.

Payroll Management

- Set the parameters and qualifications based on insurance requirements, location and experience.

- Proper construction bookkeeping lets you better understand and control your financial position and cash flow.

- When it comes to financials, the software offers bid management, change orders and purchase orders (POs).

- BooksTime provides professional services to companies that need to analyze potential returns for specific projects using accurate data and plan their expenses.

- Given the irregular cash flow patterns in construction, detailed cash flow forecasts are extremely beneficial for planning.

- Job costing is a method for allocating expenses and revenue to each specific job.

These strategies ensure that financial activities support property management objectives. Ensure you’re consistent, entering transactions promptly so you have as much real-time data as possible. To simplify this process, many construction companies use payroll software that can automatically calculate wages and taxes. These programs can also help with other aspects of payroll management, such as generating pay stubs and handling direct deposits. Finally, due to the complexity of construction projects, unforeseen issues often arise, leading to additional costs or time on the project.

While managing all the moving parts of your construction business might seem daunting, there are a few easy steps you can take to make your bookkeeping a bit less complicated. Here are some things to look for when choosing the right bookkeeping software for your construction business. The construction industry is highly susceptible to political and economic fluctuations that disrupt the supply chain. Things can happen beyond your control to destabilize your cash flow, such as bad weather conditions or a piece of equipment breaking down. If you don’t have a highly accurate and efficient construction bookkeeping system, the rest of your business will suffer. Remember, accurate financial data is your blueprint for success in the competitive construction world.

QuickBooks Online Review: Features & Pricing for 2024

It’ll help you manage all of your clients, suppliers and employees without hassle. Additional users cost extra, and you can only have one to three users, making this an accounting solution for small businesses. Launched in 2004, QuickBooks Online https://www.adprun.net/ is cloud-based accounting software used by over two million people. With strong accounting capabilities, impressive features, 650+ integrations, and fully-featured mobile apps, it’s no wonder this is one of our top accounting recommendations.

How to Set Up QuickBooks Online for Personal Use

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy. Larger businesses with sophisticated inventory, reporting and accounting needs. Creating customer groups allows you to find all customers that match certain criteria for things like location, customer type, or the customer’s status.

Step 2: Create a new chart

- Your account information is securely stored in the cloud and available anytime on all your devices.

- If you’re not sure whether you’re getting the most of these features, consider asking your accountant to review your chart of accounts and how you’re categorizing transactions.

- We believe everyone should be able to make financial decisions with confidence.

- Bank-level security ensures your data is safe and accessible only to you and the people you choose to share it with.

- This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items.

After you sign up for QuickBooks Online, you’ll be able to log in to your account and access the main dashboard view. If you’re moving to QuickBooks from another accounting software, you can import your existing files to your new account. Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade. Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance.

Mileage tracking

Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients’ money. Or let a tax expert powered by TurboTax do your taxes for you, start to finish. Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients money. Excel is a spreadsheet program that you can use for multiple functions like creating databases, project management and, yes, accounting. However, creating a solid accounting database in Excel requires a thorough knowledge of how to set up spreadsheets and all the formulas that may entail.

We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments to help you grow efficiently when you’re ready. QuickBooks Online Simple Start costs $30 per month, includes only one account user (plus access for two accountants) and does not offer billable hours tracking, bill pay or inventory management. how to write off bad debt For multiple users, bill pay and the ability to add billable hours to invoices, you’ll need to upgrade to the Essentials plan, which costs $60 per month. For inventory management, you’ll need to opt for the Plus plan at $90 per month. QuickBooks offers a separate product — QuickBooks Self-Employed — designed for freelancers and independent contractors, with plans starting at $15 per month.

Many powerful features in QuickBooks Desktop you may not even aware that they exist but they could save you a lot of time and frustration through automation. There’s also a place to manage unrecognized transactions, record credit card transfers, and view all downloaded transactions in the register. Though some may be more useful than others, all of these features are worth exploring further if they are available in your version of QuickBooks.

While QuickBooks Online isn’t the most inexpensive software, we awarded it an above-average score for pricing because it offers four scalable options, which can be ideal for growing businesses. It is available in four plans ranging from $30 to $200 per month. You can either get a 30-day free trial or purchase right away and receive a 50% discount for three months and a free online session with a QuickBooks ProAdvisor to set up your account. In addition to accounting products, QuickBooks offers payroll and POS software, along with payment processing services. QuickBooks Enterprise is the most customizable and powerful version of all the QuickBooks products, making it ideal for larger businesses with complex finances. It builds on Premier Plus with QuickBooks’ most advanced inventory, reporting and pricing capabilities.

Because QuickBooks Online is connected to the cloud, you can work from any device with an internet connection. No matter which version of QuickBooks Desktop you’re using, you can switch to QuickBooks Online quickly and seamlessly. With our online migration tool, you can move all your data or move only what’s key—like balances and specific lists. If you need help, we can migrate your data for you at no additional cost. You can factor in these item costs using a variety of criteria including quantity, value, freight, duties, weight, or volume, which in turns provides you with more accurate product cost.

Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice. QuickBooks’ mobile app is functional, but we hope to see more features in the future, such as the ability to enter bills and record time worked. Available for Android and iOS devices, it contains many features available in the browser-based desktop interface, making it one of our best mobile accounting apps.

This plan adds up to three users to the account so that the right people have access to data at their fingertips. It also gives you bill management and collects employee time for invoices to add them for proper billing. If you choose to cancel your QuickBooks Online subscription, you will still have access to your QuickBooks Money account and data. QuickBooks Online is a cloud-based accounting platform while QuickBooks is a desktop program that provides additional inventory management features. QuickBooks Online offers more features on the go and is a better overall value than QuickBooks Desktop. If you don’t need the advanced features offered by the Desktop plan, the Online version will save you money.

If you are a small business or a startup, consider QuickBooks Simple Start. Businesses that provide services, rather than goods, should consider the QuickBooks Essentials plan. Businesses with inventory will likely get the most benefit from QuickBooks Plus. Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced. QuickBooks Online is cloud-based software that can be accessed anytime and anywhere from any internet-enabled device and has monthly subscription options.

Not only is QuickBooks the dominant small business accounting software on the market today, but it also offers supplementary products to augment your overall QuickBooks experience. In addition to the QuickBooks accounting products—QuickBooks Online and QuickBooks Desktop—these are the other available solutions that can help you manage the other aspects of your business. This takes into account customer management, revenue recognition, invoice management, and collections. Both Essentials and Plus offer powerful features that can keep your small business on top of its accounting game. However, we’d definitely recommend QuickBooks Essentials for service-based businesses that don’t have products or inventory to track on a regular basis.

QuickBooks offers plenty of customer support options, including phone, email, live chat, and chatbot. However, if you want to talk with a real person, you need to submit a form and wait for them to call you—unless you upgrade to QuickBooks Online Advanced, which gives you access to https://www.personal-accounting.org/bank-reconciliation-exercise-and-answers/ premium customer support. You can add sales taxes to your receipts, invoices, and estimates, and QuickBooks Online will calculate and track them automatically for easy tax filing. It also keeps track of your tax payment due dates to avoid late filing and late payment penalties.

The software covers all the accounting bases as well as invoicing, expense tracking, accounts payable, contact management, project management, inventory, budgeting, and more. Though there are occasional navigation difficulties, QBO is incredibly easy to use overall. Best for small businesses looking for easy-to-use, cloud-based accounting software and strong mobile apps.

This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Consider what the system’s interface looks like, how the navigation works and what setup entails. Your familiarity with accounting concepts and the availability of customer support is also worth weighing. If you want to use your software anywhere you have an internet connection, you’ll likely want to focus on QuickBooks Online or pay more to add remote access through hosting to QuickBooks Enterprise. Think about the specific features you want in your software and which are most important to your business’s success. Use a free trial or ask QuickBooks for a software demo if you’re stuck between products.